Korean Air acquires 63.88% stake in Asiana Airlines

Dec 12, 2024

Korean Air has successfully acquired a 63.88 percent stake in Asiana Airlines, marking a significant consolidation in South Korea's aviation industry. This strategic move aims to strengthen the airline's market position and enhance operational efficiencies amid increasing competition and economic challenges. The acquisition is expected to streamline services and create synergies between the two carriers, ultimately benefiting customers through improved offerings. The deal reflects Korean Air's commitment to expanding its footprint in the global aviation market while addressing the financial difficulties faced by Asiana Airlines. Regulatory approvals and integration plans will be key to the successful execution of this acquisition.

Korean Air, one of the largest airlines in South Korea, has recently made headlines with its acquisition of a 63.88% stake in Asiana Airlines. This strategic move not only reshapes the competitive landscape of the aviation industry in South Korea but also sets the stage for potential growth opportunities in the global market. With this acquisition, Korean Air aims to strengthen its position as a leading airline and enhance its service offerings.

Overview of the Acquisition

The acquisition deal, which was valued at approximately $1.8 billion, marks a significant milestone for Korean Air. The airline has expressed its commitment to integrating Asiana Airlines into its operations while ensuring the preservation of brand identity and service quality. This merger is expected to create a more robust airline entity capable of competing more effectively on both domestic and international fronts.

Financial Implications of the Deal

From a financial perspective, the acquisition is anticipated to yield several benefits:

| Aspect | Impact |

|---|---|

| Cost Savings | Streamlined operations leading to reduced overhead costs |

| Increased Market Share | Combined fleets and routes enhancing competitive advantage |

| Revenue Growth | Broader customer base and expanded service offerings |

Strategic Benefits for Korean Air

The acquisition of a 63.88% stake in Asiana Airlines provides Korean Air with several strategic advantages:

- Enhanced Operational Efficiency: By merging resources, Korean Air can optimize its operations, leading to improved efficiency and reduced operational costs.

- Diverse Route Network: The integration of Asiana’s routes allows for a more extensive network, benefiting travelers with more options and convenience.

- Increased Fleet Size: The combined fleet of both airlines increases capacity and allows for better scheduling and maintenance operations.

Impact on Employees and Customers

For employees, the merger may lead to job reassessments and potential restructuring. However, Korean Air has emphasized its commitment to retaining talent from Asiana Airlines, which could foster a more diverse and skilled workforce. For customers, the acquisition is expected to bring about enhanced service quality, improved connectivity, and a wider array of flight options.

Market Reaction and Industry Insights

The market response to the acquisition announcement has been generally positive, with analysts recognizing the potential for growth and improved competitiveness. The airline industry has been under significant pressure due to the pandemic, making strategic mergers like this one a viable solution for survival and growth.

Challenges Ahead

Despite the promising outlook, Korean Air faces several challenges post-acquisition:

- Regulatory Approvals: The merger must pass through various regulatory bodies, which may impose conditions to ensure fair competition.

- Integration Hurdles: The successful integration of two distinct corporate cultures can be complex and requires careful management.

- Market Competition: Competing airlines may respond aggressively, making it essential for Korean Air to maintain a competitive edge.

Future Prospects

The future of Korean Air, post-acquisition, looks promising. With a strengthened position in the market, the airline is well-poised to explore new business opportunities, including potential partnerships and alliances with other global carriers. Additionally, there is potential for innovation in service offerings, which could significantly enhance customer satisfaction.

Conclusion

In conclusion, Korean Air’s acquisition of a 63.88% stake in Asiana Airlines represents a pivotal moment in the South Korean aviation industry. This strategic move not only aims to bolster Korean Air’s market position but also enhances its capability to deliver better services and experiences to customers. As the airline industry continues to evolve, the success of this acquisition will largely depend on effective integration and the ability to navigate the challenges that lie ahead.

As this merger unfolds, stakeholders will closely monitor the impacts on operational efficiency, market dynamics, and customer satisfaction. The collaboration between Korean Air and Asiana Airlines could serve as a significant case study for future mergers in the aviation sector.

Related Articles

Are plane tickets refundable? Your guide to the refund policies

Do You Need a Visa to Go to Canada?

We Fly TransAtlantic In Latest VIP Jet

We Fly To The World's Most Dangerous Airport & Mt Everest

We Fly Emirates First Class With Kara And Nate

We Flight Test Air NZ's New York-Auckland Nonstop

We Do Not Have Hug Police Claims NZ Airport

Watchdog Says Airlines Not Fare Gouging. But?

Watch: Snake On A Thai Plane

Watch: Another Miracle Escape - Another Valuable Lesson

Watch: Alaska Airlines Exit Door Blows Out

Watch Thomas's MH370 Interview On ABC The World

Watch Emirates Wimbledon A380 Come To Life

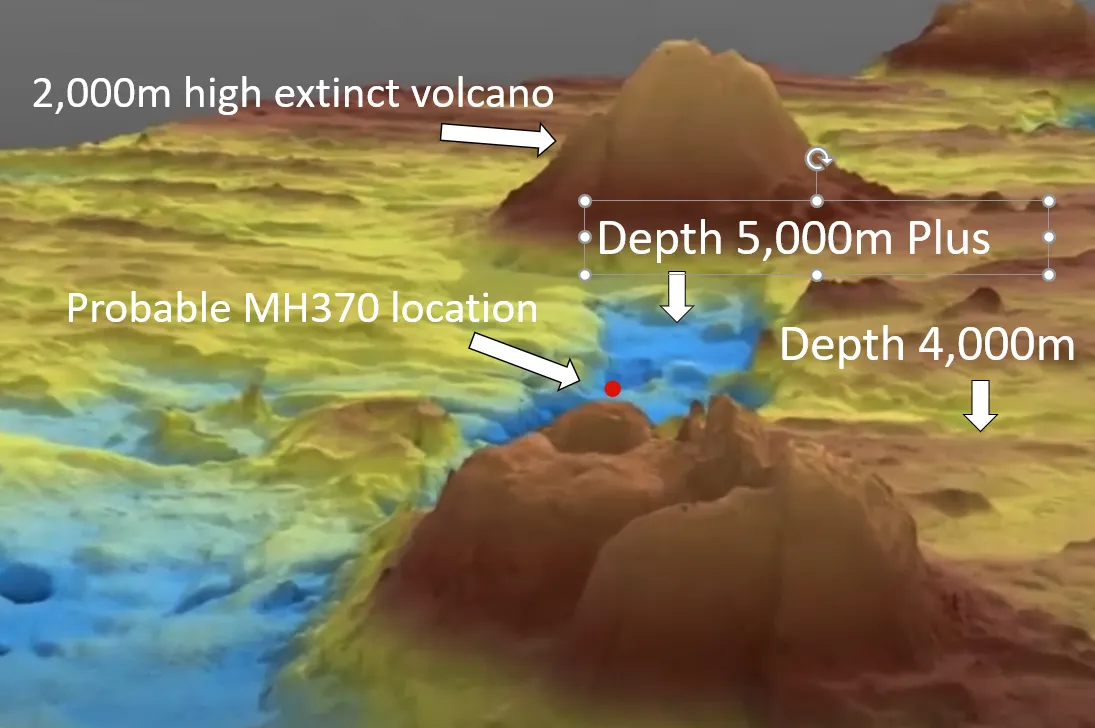

Watch a dramatic video of probable MH370 seabed location

Walk Through Boeing 777X Interior Mockup

Voepass Crash: Initial Report Released