Korean Air and Asiana Merger Confirmed

Dec 02, 2024

Korean Air has confirmed its merger with Asiana Airlines, a significant consolidation in the South Korean aviation industry. This strategic move aims to enhance operational efficiency and strengthen the global competitiveness of both airlines. The merger is expected to create the largest airline in South Korea, allowing for expanded route networks and improved service offerings. Regulatory approvals are being sought to ensure compliance with antitrust laws, and the integration process will focus on merging resources and streamlining operations. This development reflects ongoing trends in the airline industry, where companies seek to adapt to changing market dynamics and economic challenges.

The merger between Korean Air and Asiana Airlines has been a significant development in the aviation industry. This consolidation is expected to reshape the competitive landscape of air travel in South Korea and beyond. As two of the largest airlines in the country, their union will not only enhance operational efficiencies but also expand their global reach. In this article, we will delve into various aspects of this merger, its implications, and how it might affect travelers and the airline industry as a whole.

Background of the Merger

Korean Air, the flagship carrier of South Korea, has long been a dominant player in the airline market. Similarly, Asiana Airlines has carved its niche, known for its high-quality service. The merger aims to create a more robust entity that can better compete with global airlines. The process has undergone scrutiny from regulatory bodies, but the confirmation of the merger marks a new chapter for both airlines.

Implications for the Airline Industry

With the merger confirmed, several implications arise for the airline industry:

- Increased Market Share: The combined entity will hold a more substantial percentage of the South Korean aviation market, allowing for better pricing strategies and enhanced service offerings.

- Operational Efficiency: Merging resources, fleets, and operational systems can lead to significant cost savings and improved service reliability.

- Expanded Route Network: Travelers will benefit from a more extensive network of routes, making it easier to connect to international destinations.

Potential Benefits for Travelers

For passengers, the merger brings several potential benefits:

| Benefit | Description |

|---|---|

| Broader Destination Options | The combined airline will offer a more extensive network of destinations, providing travelers with more choices for both domestic and international travel. |

| Enhanced Frequent Flyer Programs | With a unified frequent flyer program, customers can earn and redeem miles more efficiently, increasing loyalty rewards. |

| Improved Customer Service | The merger may lead to enhanced customer service standards, as best practices from both airlines are implemented. |

Challenges Ahead

While the merger presents numerous opportunities, it also faces challenges:

- Regulatory Hurdles: The merger must pass through various regulatory approvals, which may take time and could result in conditions that impact the merger's execution.

- Cultural Integration: Merging two distinct corporate cultures can be challenging. The new entity will need to foster a unified culture that embraces the strengths of both airlines.

- Workforce Management: The merger may lead to job redundancies and workforce adjustments, which can create uncertainty among employees.

Financial Outlook

Financially, the merger is expected to create a more resilient airline that can withstand economic fluctuations and competitive pressures. Here is a comparative chart outlining the financial performance of each airline before the merger:

| Airline | Revenue (2022) | Net Profit (2022) |

|---|---|---|

| Korean Air | $12 billion | $1.2 billion |

| Asiana Airlines | $4 billion | $400 million |

Combining their financial strengths will create a formidable competitor in the global aviation market, potentially leading to increased investment and innovation.

Conclusion

The confirmed merger between Korean Air and Asiana Airlines is set to transform the aviation landscape in South Korea. With potential benefits for travelers, operational efficiencies, and a stronger market presence, this merger holds promise. However, the challenges ahead, including regulatory scrutiny and cultural integration, will need to be navigated carefully. As the merger progresses, stakeholders will closely monitor its impact on the airline industry and passenger experience.

In conclusion, the "Korean Air and Asiana" merger represents a pivotal moment in the airline sector, with implications that extend far beyond South Korea. For both airlines and travelers, the future looks promising, provided that the integration is managed effectively.

Related Articles

Are plane tickets refundable? Your guide to the refund policies

Do You Need a Visa to Go to Canada?

We Fly TransAtlantic In Latest VIP Jet

We Fly To The World's Most Dangerous Airport & Mt Everest

We Fly Emirates First Class With Kara And Nate

We Flight Test Air NZ's New York-Auckland Nonstop

We Do Not Have Hug Police Claims NZ Airport

Watchdog Says Airlines Not Fare Gouging. But?

Watch: Snake On A Thai Plane

Watch: Another Miracle Escape - Another Valuable Lesson

Watch: Alaska Airlines Exit Door Blows Out

Watch Thomas's MH370 Interview On ABC The World

Watch Emirates Wimbledon A380 Come To Life

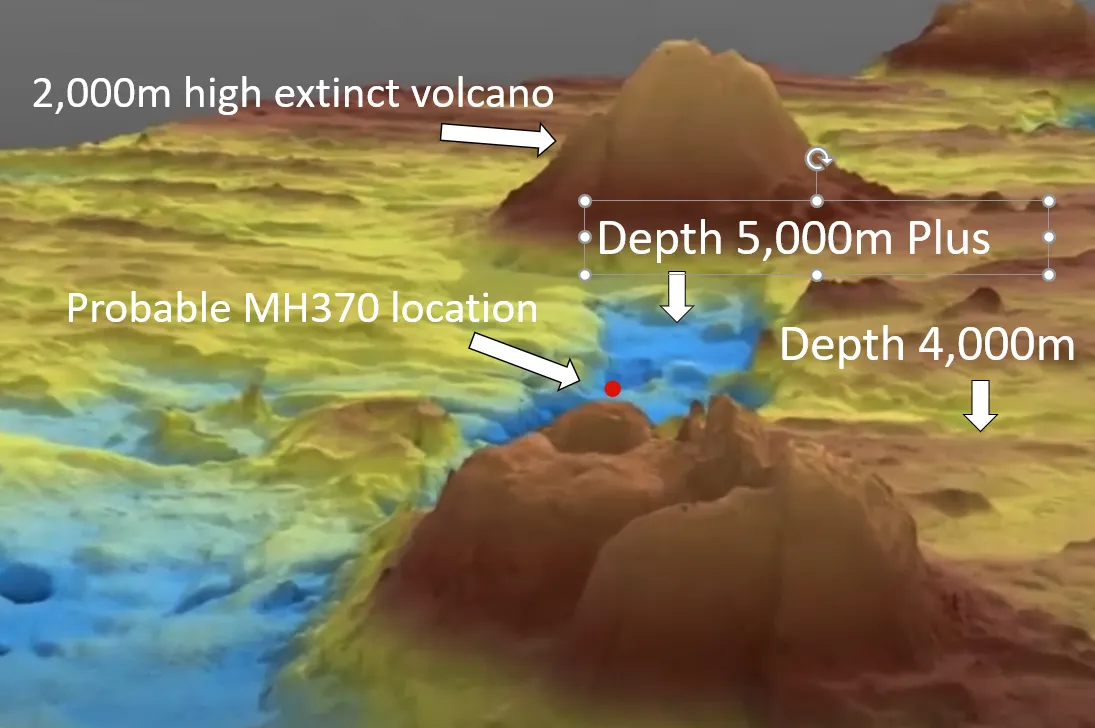

Watch a dramatic video of probable MH370 seabed location

Walk Through Boeing 777X Interior Mockup

Voepass Crash: Initial Report Released