Qatar Airways In Talks To Buy 20% Of Virgin Australia

Jun 26, 2024

Qatar Airways is reportedly in discussions to acquire a 20% stake in Virgin Australia, signaling a potential strategic partnership between the two airlines. This move comes as Virgin Australia aims to strengthen its financial position and expand its operations following its recent restructuring. The investment from Qatar Airways could provide valuable resources and enhance connectivity for both carriers, potentially benefiting travelers with improved routes and services. As negotiations progress, the aviation industry is closely watching the developments, which could reshape competitive dynamics in the Australian market and beyond.

In recent news, "Qatar Airways" has entered discussions to acquire a "20% stake in Virgin Australia", a move that could significantly reshape the competitive landscape of the airline industry. This potential investment comes as both airlines seek to expand their international reach and strengthen their market positions in a post-pandemic environment. With a growing focus on strategic partnerships, this deal could pave the way for enhanced connectivity and improved services for passengers.

Strategic Implications of the Investment

The proposed acquisition of a 20% stake in Virgin Australia by Qatar Airways is not just about financial investment; it is also about strategic alignment. Both airlines have a strong presence in their respective markets, and this partnership could lead to significant benefits, including:

- Enhanced Connectivity: With Qatar Airways' extensive global network and Virgin Australia's domestic strength, the partnership could create a seamless travel experience for passengers.

- Joint Marketing Efforts: Both airlines can leverage their brands to attract more customers through collaborative marketing strategies.

- Operational Synergies: Potential cost savings and improved efficiency through shared resources and operational practices.

Market Response and Industry Reactions

The announcement of Qatar Airways' interest in Virgin Australia has sparked a variety of reactions within the airline industry. Analysts are keenly observing how this partnership might influence competitive dynamics in the Australian market. Here’s a breakdown of key market reactions:

| Stakeholder | Reaction |

|---|---|

| Industry Analysts | Positive outlook on increased competition and service improvements. |

| Competitors | Heightened concern regarding market share and pricing strategies. |

| Consumers | Expectation of better pricing and enhanced travel options. |

Qatar Airways: A Global Aviation Leader

As one of the fastest-growing airlines in the world, "Qatar Airways" has established a reputation for excellence in service and innovation. The airline has consistently ranked among the top carriers globally, offering a wide range of destinations and premium services. Key highlights include:

- Extensive Route Network: Connecting more than 160 destinations worldwide.

- Award-Winning Service: Recognized for outstanding customer service and onboard experience.

- Modern Fleet: Comprising state-of-the-art aircraft designed for passenger comfort and efficiency.

Virgin Australia: A Strong Contender in the Market

Virgin Australia has been a formidable player in the Australian aviation sector, known for its commitment to quality and customer satisfaction. The airline has undergone several transformations in recent years, focusing on improving its operational efficiency and expanding its route offerings. Notable aspects include:

- Domestic and International Operations: Serving a wide range of domestic routes while also expanding into international markets.

- Customer-Centric Approach: Prioritizing passenger experience through loyalty programs and innovative services.

- Financial Resilience: Successfully navigating challenges in the aviation industry and emerging stronger post-COVID-19.

Potential Benefits for Passengers

The potential partnership between Qatar Airways and Virgin Australia could yield numerous benefits for travelers. Some of the anticipated advantages include:

- Improved Flight Options: Increased choices for passengers with more direct flights and connections.

- Seamless Travel Experience: Enhanced coordination between airlines for smoother transfers and check-in processes.

- Competitive Pricing: More competitive pricing structures providing better value for customers.

Challenges Ahead

Despite the promising outlook, there are challenges that both airlines may face as they move forward with this potential acquisition. These challenges include:

- Regulatory Approvals: Navigating the complexities of regulatory frameworks in both Australia and international markets.

- Market Competition: Competing against established players in the aviation sector who may respond aggressively to protect their market share.

- Integration Issues: Ensuring smooth integration of operations, culture, and customer service standards.

Conclusion

As "Qatar Airways" moves forward with its plans to acquire a "20% stake in Virgin Australia", the aviation industry watches with keen interest. This potential investment could herald a new era of collaboration and competition, ultimately benefiting travelers and the overall market. The partnership promises to enhance connectivity, improve services, and create a more dynamic travel experience for customers. As discussions progress, stakeholders will be closely monitoring developments to understand the full implications of this strategic move.

Related Articles

Are plane tickets refundable? Your guide to the refund policies

Do You Need a Visa to Go to Canada?

We Fly TransAtlantic In Latest VIP Jet

We Fly To The World's Most Dangerous Airport & Mt Everest

We Fly Emirates First Class With Kara And Nate

We Flight Test Air NZ's New York-Auckland Nonstop

We Do Not Have Hug Police Claims NZ Airport

Watchdog Says Airlines Not Fare Gouging. But?

Watch: Snake On A Thai Plane

Watch: Another Miracle Escape - Another Valuable Lesson

Watch: Alaska Airlines Exit Door Blows Out

Watch Thomas's MH370 Interview On ABC The World

Watch Emirates Wimbledon A380 Come To Life

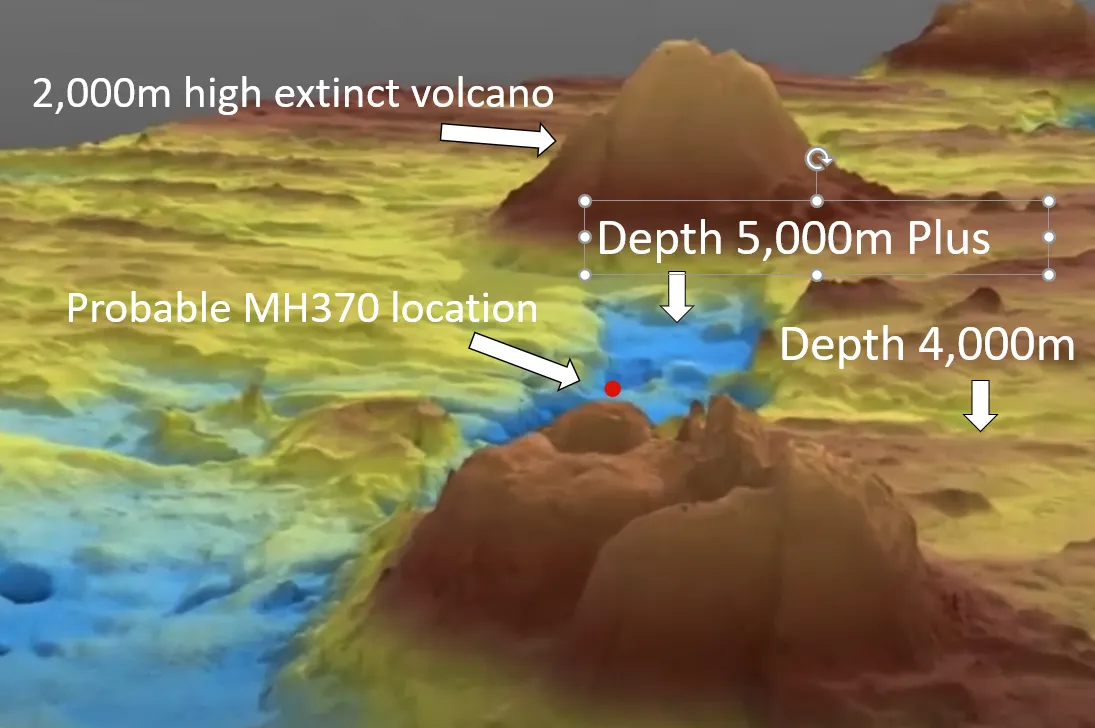

Watch a dramatic video of probable MH370 seabed location

Walk Through Boeing 777X Interior Mockup

Voepass Crash: Initial Report Released