Transatlantic Low Cost Carrier to Raise Capital

Nov 01, 2023

A transatlantic low-cost carrier is seeking to raise capital to expand its operations and enhance its market presence. This airline aims to offer affordable travel options between North America and Europe, catering to budget-conscious travelers. By securing additional funding, it plans to invest in fleet upgrades, improve customer services, and increase its route network. The carrier's business model focuses on maximizing efficiency and minimizing costs, allowing it to compete with traditional airlines effectively. As it navigates the competitive aviation landscape, raising capital is crucial for sustaining growth and achieving long-term profitability.

As the aviation industry continues to evolve, "transatlantic low-cost carriers" are finding innovative ways to raise capital to support their growth and expansion strategies. These airlines have become increasingly popular among travelers looking for affordable transatlantic flights, and as demand rises, so does the need for investment to maintain and enhance their operations. This article explores the methods employed by these airlines to secure funding and the implications for the future of air travel across the Atlantic.

Understanding the Transatlantic Low-Cost Carrier Market

The "transatlantic low-cost carrier" market has witnessed significant growth over the last decade. Airlines like Norwegian Air, WOW air, and others have disrupted traditional carriers by offering competitive pricing and no-frills services. However, as operational costs rise, these airlines must explore creative ways to raise capital.

According to industry reports, the demand for budget-friendly options is expected to continue its upward trajectory, prompting low-cost carriers to enhance their service offerings. This expansion often requires substantial investment in fleet upgrades, technology, and marketing, which leads to the need for effective capital-raising strategies.

Capital Raising Strategies for Low-Cost Carriers

Transatlantic low-cost carriers are employing various strategies to raise capital. Here are some of the most common methods:

1. Public Offerings

Many airlines have taken the route of going public to raise funds. By offering shares to the public, they can generate significant capital to reinvest into their operations. For example, Norwegian Air successfully executed multiple public offerings that allowed them to expand their fleet and increase their market presence.

2. Private Equity Investments

Private equity firms are increasingly interested in investing in low-cost carriers due to their growth potential. These investments can provide airlines with the necessary capital while also bringing in strategic expertise to help navigate the competitive landscape. This form of funding has become a vital source of capital for many carriers.

3. Partnerships and Alliances

Strategic partnerships with other airlines or companies can also provide low-cost carriers with opportunities to share resources and reduce costs. By forming alliances, airlines can pool their resources for joint marketing efforts, shared technology, and even coordinated schedules, ultimately leading to capital savings and increased revenue.

4. Government Support

In some cases, governments offer support to low-cost carriers, especially during challenging economic times. This support can come in various forms, including grants, loans, or tax incentives, which can significantly ease financial burdens and allow airlines to focus on growth.

Investment Implications

Raising capital is not just about securing funds but also about understanding the implications of these investments. For "transatlantic low-cost carriers", the influx of capital can lead to:

- Fleet Expansion: With more funds, airlines can acquire new aircraft, leading to an expanded network and increased capacity.

- Improved Services: Investment allows for enhancements in customer service, including better in-flight experiences and customer support.

- Technological Advancements: Upgrading technology can streamline operations, enhance safety, and improve operational efficiency.

Challenges in Raising Capital

Despite the various methods available for raising capital, transatlantic low-cost carriers face several challenges. The aviation industry is highly competitive, and these airlines must differentiate themselves to attract investors. Some challenges include:

- Market Volatility: Economic downturns and global crises, such as pandemics, can severely impact the aviation sector, making investors wary.

- Regulatory Hurdles: The aviation industry is heavily regulated, and compliance can be costly, impacting the financial health of low-cost carriers.

- Operational Costs: Rising fuel prices and maintenance costs can affect profitability, making it challenging to attract investment.

The Future of Transatlantic Low-Cost Carriers

As "transatlantic low-cost carriers" continue to adapt to the changing landscape, their ability to raise capital will play a crucial role in shaping the future of air travel. Investors are likely to remain interested in this segment due to its potential for growth and the increasing demand for affordable travel options.

In conclusion, the strategies that transatlantic low-cost carriers employ to raise capital are a testament to their resilience and adaptability in a competitive market. By focusing on innovative funding solutions, these airlines can continue to provide affordable travel options while paving the way for future growth. The aviation industry's evolution will undoubtedly be influenced by the success of these capital-raising efforts.

Chart: Growth of Transatlantic Low-Cost Carriers

| Year | Number of Passengers (in millions) | Average Ticket Price ($) |

|---|---|---|

| 2018 | 15 | 300 |

| 2019 | 18 | 280 |

| 2020 | 8 | 320 |

| 2021 | 10 | 250 |

| 2022 | 12 | 270 |

| 2023 | 14 | 260 |

This chart illustrates the growth trajectory of "transatlantic low-cost carriers" over the years, highlighting the fluctuations in passenger numbers and average ticket prices. As these airlines continue to innovate and raise capital, the outlook for affordable transatlantic travel remains promising.

Related Articles

Are plane tickets refundable? Your guide to the refund policies

Do You Need a Visa to Go to Canada?

We Fly TransAtlantic In Latest VIP Jet

We Fly To The World's Most Dangerous Airport & Mt Everest

We Fly Emirates First Class With Kara And Nate

We Flight Test Air NZ's New York-Auckland Nonstop

We Do Not Have Hug Police Claims NZ Airport

Watchdog Says Airlines Not Fare Gouging. But?

Watch: Snake On A Thai Plane

Watch: Another Miracle Escape - Another Valuable Lesson

Watch: Alaska Airlines Exit Door Blows Out

Watch Thomas's MH370 Interview On ABC The World

Watch Emirates Wimbledon A380 Come To Life

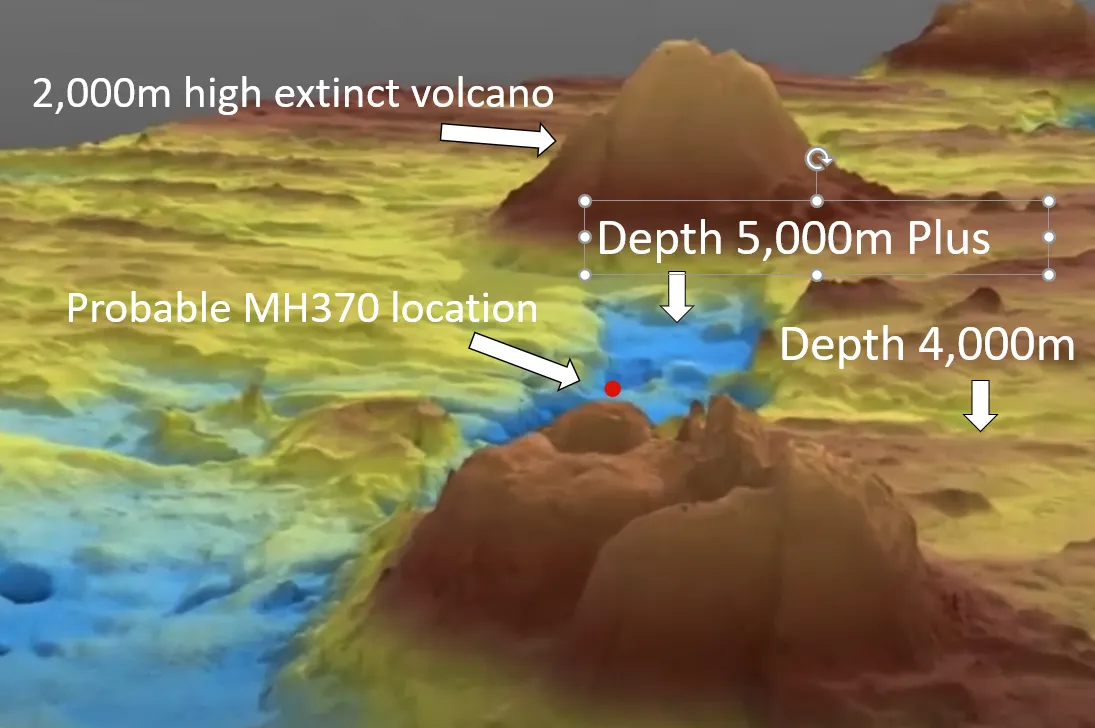

Watch a dramatic video of probable MH370 seabed location

Walk Through Boeing 777X Interior Mockup

Voepass Crash: Initial Report Released