Travel insurance 101

Feb 17, 2025

When planning a trip, one of the most essential considerations is obtaining the right "travel insurance". Understanding the different types of coverage available can help ensure your journey is not only enjoyable but also protected. This guide will break down the basics of "travel insurance", its types, and why it is important for every traveler.

What is Travel Insurance?

"Travel insurance" is a policy designed to cover potential risks associated with traveling, such as trip cancellations, medical emergencies, lost luggage, and other unforeseen events. This type of insurance provides peace of mind, allowing travelers to focus on their adventures instead of worrying about what could go wrong.

Types of Travel Insurance

There are several types of "travel insurance" policies available, each catering to different needs. Here’s a breakdown of the most common types:

| Type of Insurance | Description |

|---|---|

| Trip Cancellation Insurance | Covers non-refundable expenses if you need to cancel your trip due to illness, family emergencies, or other covered reasons. |

| Medical Coverage | Offers protection against medical expenses incurred while traveling, such as hospital visits or emergency evacuations. |

| Evacuation Insurance | Covers costs associated with medical evacuations and repatriation in case of a severe health issue or natural disaster. |

| Lost Luggage Insurance | Provides compensation for lost, stolen, or damaged baggage and personal belongings during your trip. |

| Travel Delay Insurance | Covers costs incurred due to travel disruptions, such as hotel stays and meals, if your trip is delayed. |

Why You Need Travel Insurance

Investing in "travel insurance" is crucial for numerous reasons, including:

- Protection from Financial Loss: Unexpected events can lead to significant financial losses. "Travel insurance" helps mitigate these losses.

- Emergency Assistance: Many policies offer 24/7 assistance services, providing travelers with support during emergencies.

- Peace of Mind: Knowing you’re covered allows you to relax and enjoy your trip without constant worry about potential risks.

How to Choose the Right Travel Insurance

Selecting the appropriate "travel insurance" policy involves careful consideration of your needs, travel destination, and activities planned. Here are some tips to help you choose wisely:

- Assess Your Needs: Determine what type of coverage is important for your trip, such as medical coverage for adventurous activities or trip cancellation for pre-paid tours.

- Compare Policies: Look at multiple insurance providers to compare coverage options, limits, and costs. Websites that aggregate insurance options can be very helpful.

- Read the Fine Print: Understand the terms and conditions of the policy, including exclusions and limitations. This knowledge helps avoid surprises when filing a claim.

- Check Reviews: Research customer experiences with different insurance companies to gauge their reliability and customer service.

Common Exclusions in Travel Insurance

While "travel insurance" can provide extensive coverage, it is essential to be aware of common exclusions. These may include:

- Pre-existing medical conditions

- Traveling against government advisories

- Adventure sports without additional coverage

- Cancellations due to non-covered reasons (e.g., change of mind)

Conclusion

In conclusion, "travel insurance" is a vital part of any travel plan. It offers protection against unexpected events that could derail your trip and provides peace of mind. By understanding the types of coverage available and carefully selecting a policy that suits your needs, you can travel with confidence. Always remember to read the policy details and be aware of any exclusions to ensure the best protection for your travel adventures.

With this "Travel Insurance 101" guide, you are now better equipped to navigate the world of "travel insurance" and make informed decisions for your future travels.

Related Articles

Discover How Overpacking Can Enhance Your Travel Experience: Ellie Bamber Shares Her Secrets

The ultimate Japan itinerary for first-timers

Gay Pride Wars: San Francisco vs. New York City

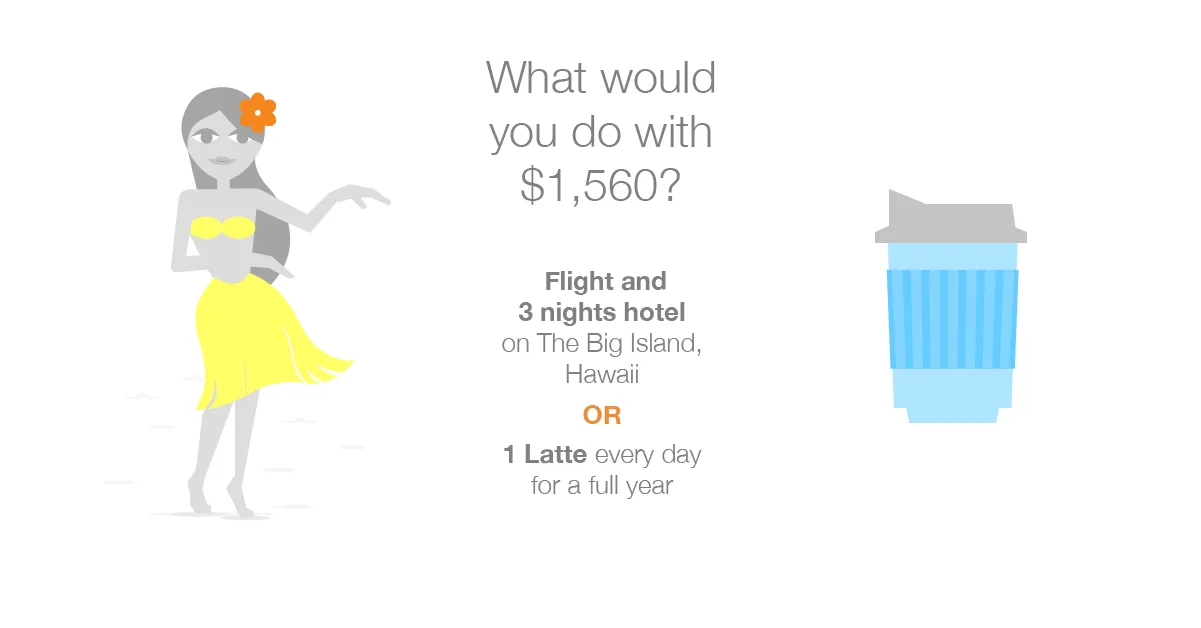

Would you rather…? Experiences vs. Possessions

Tips for Traveling to Where the Grass is Greener (and Legal)

An Honest First-Timer’s Guide To Sri Lanka

The best of travel, according to travelers

7 ways to overcome the post-vacation blues

7 tips to prepare yourself for a future trip

Breastfeeding and travel: Everything you need to know

An insider;s guide to becoming a digital nomad

Vanlife, no filter: One woman’s journey to life on the road

What to know about becoming a nomad from women who’ve done it

Pride Guide: Where to celebrate Pride in 2021

How to travel safely as an LGBTQ+ traveler

7 tips for traveling with food allergies