US airlines warn of liquidity fears with $US10 billion monthly cash burn

Mar 19, 2020

US airlines are expressing concerns over their financial stability as they face a staggering cash burn of approximately ten billion dollars each month. This alarming rate of expenditure raises significant liquidity fears, prompting industry leaders to seek urgent solutions to sustain their operations. The ongoing challenges, exacerbated by fluctuating travel demand and economic uncertainties, have led to calls for government assistance and strategic adjustments. Airlines are now focusing on cost-cutting measures and exploring new revenue streams to navigate this precarious financial landscape, highlighting the critical need for a resilient recovery plan in an evolving market.

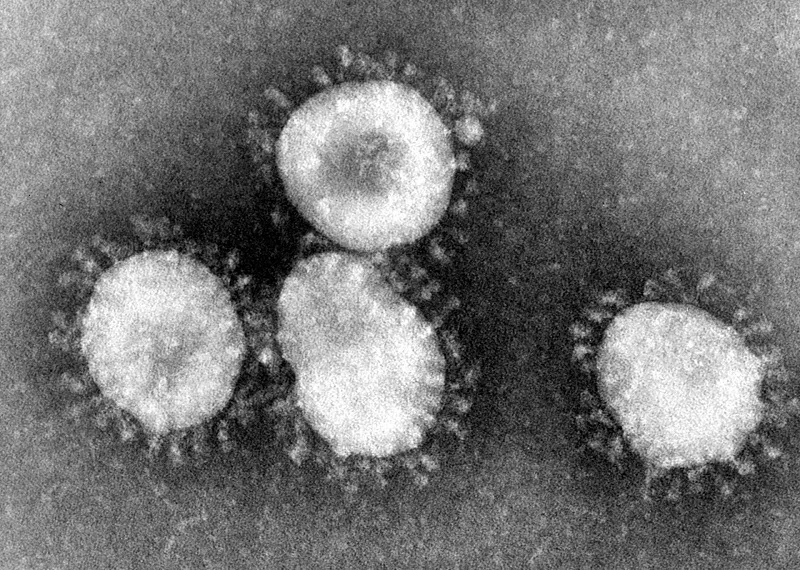

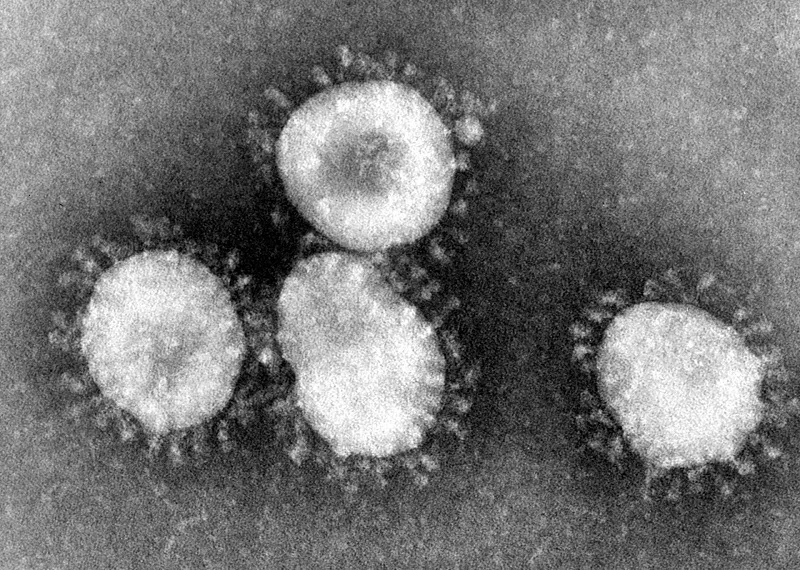

As the airline industry grapples with the aftermath of the COVID-19 pandemic, a stark warning has emerged from US carriers regarding their financial health. With "liquidity fears" escalating, major airlines are facing a daunting challenge: a staggering "$10 billion monthly cash burn". This alarming statistic highlights the urgent need for strategic planning and financial management in a sector that has been severely impacted by travel restrictions and reduced passenger demand.

Understanding Cash Burn in the Airline Industry

In the context of airlines, "cash burn" refers to the rate at which a company spends its cash reserves to cover operational expenses when revenue is insufficient. The current situation is particularly concerning given the high fixed costs associated with running an airline, including aircraft maintenance, employee salaries, and airport fees. With revenues plummeting, many airlines are forced to dip into their cash reserves at an unprecedented rate.

The Factors Contributing to High Cash Burn

Several factors contribute to the significant monthly cash burn experienced by US airlines:

| Factor | Description |

|---|---|

| Reduced Passenger Demand | Travel restrictions and changing consumer behavior have led to a sharp decline in air travel. |

| Operational Costs | Airlines must continue to pay for fixed costs, including aircraft leasing and maintenance, regardless of passenger numbers. |

| Debt Obligations | Many airlines have taken on significant debt to survive the downturn, increasing their monthly cash outflows. |

| Fuel Prices | Fluctuating fuel prices can impact operational costs, further straining cash reserves. |

Implications for Airlines and Their Stakeholders

The "liquidity fears" highlighted by the $10 billion cash burn have far-reaching implications for airlines and their stakeholders. For investors, the prospect of dwindling cash reserves raises concerns about the long-term viability of airlines. These financial pressures could lead to a wave of bankruptcies or mergers as weaker companies struggle to stay afloat.

Additionally, employees within the airline industry face job security issues as airlines look to cut costs. Layoffs and furloughs are becoming increasingly common as companies navigate these turbulent waters. The ripple effect extends to related industries, including tourism, hospitality, and transportation, which rely heavily on a healthy airline sector.

Strategies to Mitigate Cash Burn

In response to these challenges, airlines are exploring various strategies to mitigate their cash burn:

- Cost-Cutting Measures: Many airlines are implementing cost-cutting initiatives, which may include reducing flight frequencies, deferring aircraft purchases, and renegotiating contracts with suppliers.

- Government Support: Seeking aid from government programs designed to support struggling industries can provide much-needed financial relief.

- Innovative Revenue Streams: Airlines are exploring new revenue opportunities, such as cargo services, ancillary fees, and partnerships with travel-related businesses.

- Operational Efficiency: Investing in technology to streamline operations and improve efficiency can help reduce costs in the long run.

The Importance of Financial Resilience

As the airline industry faces these liquidity fears, the importance of "financial resilience" cannot be overstated. Airlines must adapt to the changing landscape by developing robust financial strategies that prioritize sustainability. This includes maintaining adequate cash reserves, diversifying revenue streams, and being prepared for future disruptions.

Furthermore, transparency and communication with stakeholders are vital. Airlines that can effectively convey their strategies and outlook will likely foster greater trust among investors, employees, and customers. This trust can be instrumental in navigating the ongoing challenges posed by the pandemic and beyond.

Looking Ahead: The Future of US Airlines

Despite the current challenges, there is a glimmer of hope for the future of US airlines. As vaccination rates rise and travel restrictions ease, there is potential for a rebound in passenger demand. However, airlines must remain vigilant in managing their cash flow and adapting to evolving market conditions.

In conclusion, the warning from US airlines about "liquidity fears" and the staggering "$10 billion monthly cash burn" serves as a wake-up call for the industry. By adopting proactive strategies and prioritizing financial resilience, airlines can position themselves for recovery and long-term success in a post-pandemic world. Stakeholders must stay informed and engaged as the situation continues to develop, ensuring that they are prepared for both challenges and opportunities that lie ahead.

Related Articles

Worried passengers swamp airline customer service centers

World’s longest flight was a night, a day and a night to remember.

World's Safest Airlines ; Qantas tops once again as safest airline for 2021

World's longest flight will only take 17 hours

Workplace watchdog orders Qantas to improve aircraft cleaning

Will the Airbus A380 be the next coronavirus victim?

Walsh to stay on as IAG cuts capacity by 75 percent

Virus sees China drop from third-biggest international market to 25th

Virgin offers quick way home for Aussies facing restrictions

Virgin Australia downgrade underscores need for government aid

US upgrades coronavirus travel warnings to Italy, South Korea, Iran

US expands Wuhan virus screening to Atlanta and Chicago

US CDC develops comprehensive plan to screen passengers to combat deadly virus.

US airlines suspend flights to South Korea

US airlines must fly to all ports to access aid payments

US airlines look to put passengers on each other's flights