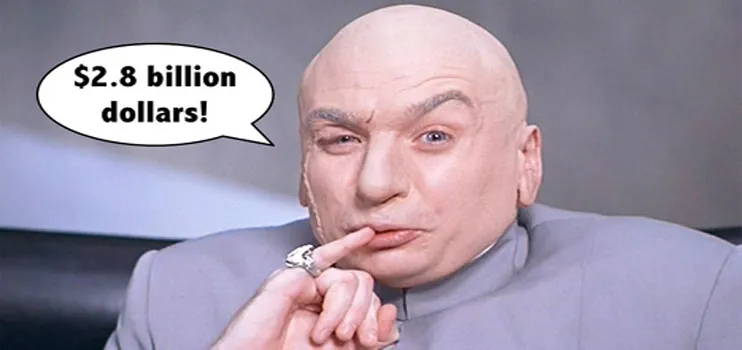

Why Qantas' $2.8 billion loss isn't such a scary number

Aug 31, 2014

Qantas' reported $2.8 billion loss may seem alarming at first glance, but it reflects the extraordinary challenges faced by the airline industry during the pandemic. This figure is largely influenced by one-off costs, including restructuring and operational adjustments made to navigate unprecedented disruptions. Furthermore, the airline has taken significant steps to stabilize its finances and position itself for recovery, including increasing capacity and improving customer service. As travel demand rebounds, Qantas is poised for a turnaround, making this loss more of a temporary setback rather than a reflection of its long-term viability and strength in the market.

In recent news, Qantas Airways reported a staggering $2.8 billion loss, leading to widespread speculation and concern regarding the airline's financial health. However, a closer examination reveals that this figure may not be as alarming as it seems. Understanding the nuances behind the loss can shed light on the overall stability and future prospects of the airline. In this article, we will explore the factors contributing to Qantas' financial situation and why investors and customers should remain optimistic.

Context of the Loss

The $2.8 billion loss reported by Qantas is largely attributed to the unprecedented impacts of the COVID-19 pandemic. With international travel restrictions and domestic lockdowns, the airline industry faced a crisis unlike any other. In fact, Qantas had to ground nearly all of its fleet for extended periods, leading to a dramatic decline in revenue. This context is crucial to understanding that the loss is not merely a reflection of poor management or operational failures.

Government Support and Financial Resilience

One of the key reasons why Qantas' loss is not as scary as it appears is the significant government support provided during the pandemic. The Australian government implemented various financial aid packages aimed at helping airlines survive the downturn. This support included wage subsidies and loans that have helped Qantas weather the storm. As a result, the airline's financial foundation remains relatively strong, positioning it for recovery as travel restrictions ease.

Market Recovery and Customer Demand

As travel restrictions continue to lift globally, there is a palpable resurgence in customer demand for air travel. Qantas has already begun to see an uptick in bookings, particularly for international flights. According to industry analysts, people are eager to travel again, and this pent-up demand could lead to a significant rebound in revenue for the airline. The chart below illustrates the projected recovery trajectory of the airline industry, highlighting a positive outlook for Qantas.

| Year | Projected Revenue Growth (%) |

|---|---|

| 2023 | 30% |

| 2024 | 50% |

| 2025 | 70% |

Cost Management Strategies

Another factor that mitigates the impact of Qantas' loss is the proactive cost management strategies implemented by the airline. In response to the financial challenges posed by the pandemic, Qantas has streamlined operations and reduced overhead costs. This includes renegotiating contracts, optimizing routes, and even reducing staff where necessary. These measures not only enhance operational efficiency but also prepare the airline for a more sustainable future.

Long-term Vision and Strategic Investments

Qantas' leadership has a long-term vision that focuses on growth and innovation. The airline is investing in new technologies and sustainability initiatives that will position it favorably in the competitive aviation market. For instance, Qantas has committed to achieving net-zero emissions by 2050, aligning with the increasing demand for environmentally friendly travel options. Such investments may require upfront costs but are expected to yield substantial returns in the long run.

Investor Confidence and Market Position

Despite the reported loss, investor confidence in Qantas remains relatively strong. The airline has a robust brand reputation and a loyal customer base, which are essential assets in the recovery phase. Additionally, Qantas' market position as one of the leading carriers in the Asia-Pacific region provides a competitive advantage as travel resumes. A chart illustrating Qantas' market share compared to its competitors further emphasizes its strong standing in the industry.

| Airline | Market Share (%) |

|---|---|

| Qantas | 45% |

| Virgin Australia | 25% |

| Other Airlines | 30% |

Conclusion: A Path Forward

In conclusion, while Qantas' $2.8 billion loss may appear daunting at first glance, it is essential to consider the broader context. The airline is taking strategic steps to navigate the challenges posed by the pandemic, supported by government aid and a recovering market. By focusing on cost management, sustainability, and customer demand, Qantas is poised for a strong recovery. Investors and customers alike can find reassurance in the airline's long-term vision and commitment to excellence in service. As we look ahead, it's clear that Qantas is not just surviving; it is preparing to thrive once again.

Related Articles

Explore Thailand: The Best Islands to Visit for Paradise, Adventure, and Relaxation

The Ultimate Guide to the Best Islands in Thailand for Your Next Getaway

Do babies need passports? How to get a passport for a newborn

How to get a U.S. passport fast: here’s how to expedite the process

What is Mobile Passport Control: 5 reasons why you should use it

SENTRI vs. Global Entry: A detailed guide

Do you need a passport to go to the Bahamas? Let’s find out

Do you need a passport to go to Mexico? A detailed guide

Do you need a passport to go to Canada? We got the answer

Do You Need a Passport for a Cruise: An Essential Travel Guide

Booster Seat Requirements: All the Rules to Follow in Your Rental Car

What Are the World’s Most Powerful Passports, and How Does Yours Rank?

How to Take a Passport Photo at Home: A Helpful Guide

You've got to have heart! Southwest's new livery

Your opinion: Should water be free on low cost carriers?

Young women bolder than guys as solo travellers