Qantas boosts liquidity with $A1.05 billion loan

Mar 25, 2020

Qantas has secured a significant loan of A1.05 billion to enhance its liquidity amid ongoing challenges in the aviation industry. This financial boost aims to strengthen the airline's balance sheet and support its operations as it navigates a fluctuating market environment. The loan reflects Qantas's commitment to financial stability while positioning itself for future growth opportunities. With this funding, the airline intends to bolster its recovery efforts and maintain its strategic initiatives in the face of evolving industry dynamics. The move underscores the importance of financial resilience in ensuring sustained competitiveness in the travel sector.

In a strategic move to enhance its financial stability amid ongoing challenges in the aviation industry, Qantas Airways has successfully secured a substantial loan of $A1.05 billion. This financial maneuver is designed to bolster the airline's liquidity and ensure its resilience in navigating the complexities of the post-pandemic recovery phase.

The Rationale Behind the Loan

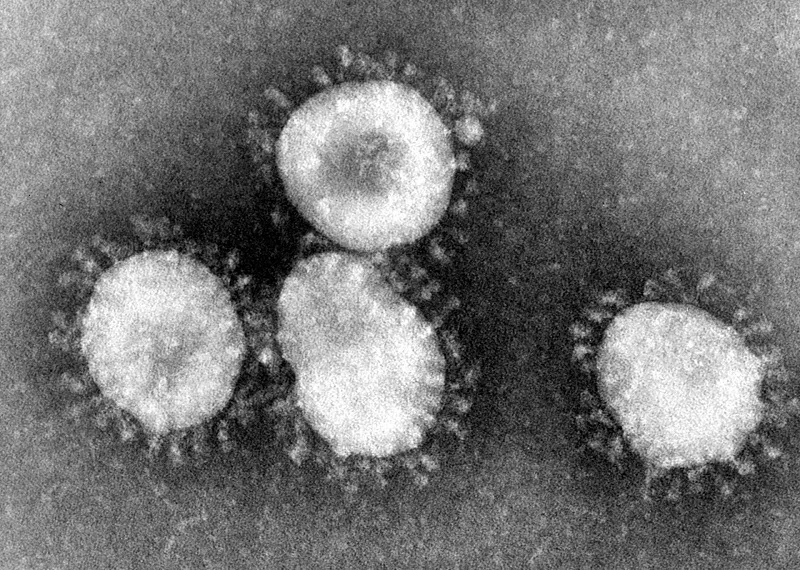

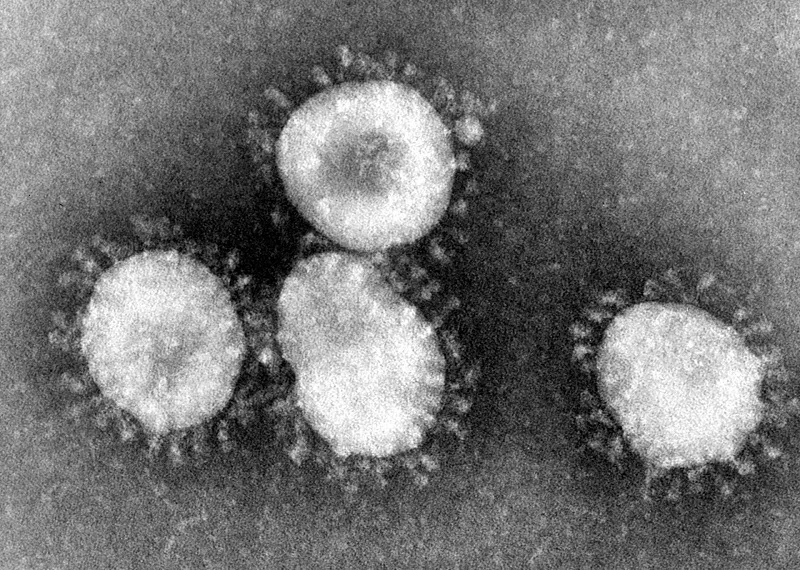

As the global aviation sector gradually rebounds from the impact of COVID-19, airlines are facing a myriad of challenges, including fluctuating demand, rising fuel costs, and operational disruptions. Qantas, being one of the world's leading airlines, recognized the need for a robust financial buffer to safeguard its operations and future growth prospects. The $A1.05 billion loan is a critical step in this direction, allowing the airline to maintain operational flexibility and invest in strategic initiatives.

Key Features of the Loan

The loan comes with several key features aimed at ensuring Qantas can effectively leverage these funds. Here are some of the notable aspects:

| Feature | Description |

|---|---|

| Amount | $A1.05 billion |

| Purpose | Boost liquidity and enhance financial stability |

| Loan Type | Secured loan with favorable terms |

| Duration | 5 years |

| Interest Rate | Competitive rate based on market conditions |

Implications for Qantas

This significant infusion of capital not only provides Qantas with the necessary liquidity but also emphasizes the airline's commitment to maintaining its operational capabilities. With the aviation industry still in recovery mode, having a strong financial position is crucial for Qantas to navigate potential uncertainties.

In addition to enhancing its liquidity, this loan will allow Qantas to invest in various strategic initiatives, such as:

- Fleet Modernization: Upgrading aircraft to improve fuel efficiency and reduce operational costs.

- Technology Investments: Implementing advanced booking and customer service systems to enhance the passenger experience.

- Market Expansion: Exploring new routes and markets to diversify its revenue streams.

Market Reactions and Analyst Insights

The announcement of the $A1.05 billion loan has elicited mixed reactions from market analysts and investors. Some view it as a necessary step towards financial recovery, while others express concerns about the long-term implications of increased debt levels. However, experts generally agree that maintaining liquidity is paramount in the current volatile environment.

Industry analysts have noted that Qantas' proactive measures, including this loan, demonstrate its commitment to long-term sustainability. The airline's ability to adapt to changing market conditions will be crucial in maintaining its competitive edge.

Future Outlook for Qantas

Looking ahead, Qantas is poised to leverage this liquidity boost to navigate the evolving landscape of the aviation industry. As travel demand continues to recover, the airline is expected to benefit from increased passenger numbers, particularly in domestic markets and popular international routes.

Moreover, with the support of the $A1.05 billion loan, Qantas has the opportunity to strengthen its brand and customer loyalty. By investing in better services and operational efficiencies, the airline can position itself favorably against its competitors.

Conclusion

In conclusion, Qantas' decision to secure a $A1.05 billion loan is a strategic maneuver aimed at reinforcing its liquidity and ensuring operational resilience in a challenging market environment. With this financial backing, the airline can pursue its growth strategies and adapt to the evolving demands of the aviation industry.

As Qantas continues to navigate the complexities of post-pandemic recovery, the airline's ability to effectively utilize this loan will be pivotal in shaping its future trajectory. Stakeholders, including investors and customers, will be closely watching how Qantas capitalizes on this opportunity to emerge stronger in the highly competitive aviation sector.

Related Articles

Worried passengers swamp airline customer service centers

World’s longest flight was a night, a day and a night to remember.

World's Safest Airlines ; Qantas tops once again as safest airline for 2021

World's longest flight will only take 17 hours

Workplace watchdog orders Qantas to improve aircraft cleaning

Will the Airbus A380 be the next coronavirus victim?

Walsh to stay on as IAG cuts capacity by 75 percent

Virus sees China drop from third-biggest international market to 25th

Virgin offers quick way home for Aussies facing restrictions

Virgin Australia downgrade underscores need for government aid

US upgrades coronavirus travel warnings to Italy, South Korea, Iran

US expands Wuhan virus screening to Atlanta and Chicago

US CDC develops comprehensive plan to screen passengers to combat deadly virus.

US airlines warn of liquidity fears with $US10 billion monthly cash burn

US airlines suspend flights to South Korea

US airlines must fly to all ports to access aid payments